thrive-cb domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /wordpress/wp-includes/functions.php on line 6121

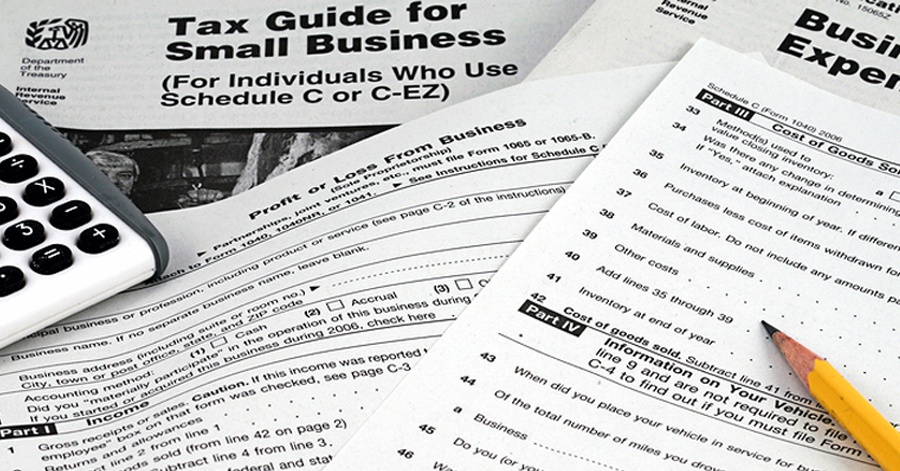

If you’re a business owner, you most likely have tax questions and tax concerns. Simply put, it makes dollars and sense to partner with an experienced tax professional for personalized guidance and advice.Whether it’s a question about your personal taxes, including earned income tax credit, child tax credit, or a question about your business taxes, […]

Continue reading

As a business owner, you work hard to earn a living and grow your business. However, if your tax planning and financial planning aren’t working together in tandem, you’re leaving money on the table. Fortunately, the team at John F. Dennehy CPA can help.We specialize in offering financial planning and tax planning services for small […]

Continue reading

As a business owner, it’s imperative you know whether you should pay your taxes quarterly or yearly. While individuals pay their federal income tax as they receive or earn income throughout the year, the process can look a little to a lot different for small businesses and individual contractors. This difference is due to the […]

Continue reading

COVID-19 changed everything, including taxes. But it didn’t change the importance of having a robust end-of-year tax planning checklist. In fact, it’s more important than ever for you to have an end of year tax planning checklist. Considering all of the legislative changes and modifications, your end of the year tax planning checklist can be […]

Continue reading

Savvy business owners understand tax season is a year-round event; and as soon as the tax deadline passes, they’re able to shift their focus more toward preparing for next year’s taxes. Failure to prepare for next year’s taxes early often results in you paying Uncle Sam way more than you should. However, when you proactively […]

Continue reading

At John F. Dennehy CPA, one of the most common questions we receive from businesses is “Do I need to pay quarterly taxes?” Unfortunately, the answer to this question depends on the type of business you own as well as other factors. Even though April 15th is the well-publicized tax deadline, certain types of business […]

Continue reading

Differences Between an S-Corp vs C-CorpThere are several important differences between these kinds of corporations. One of them has everything to do with taxation. C-corporations are widely regarded as tax-unfriendly entities, the primary complaint being “double taxation.” The business entity is taxed by the government with corporate income taxes, and the personal income of the […]

Continue reading

If you’re at a point of deciding what kind of business structure to form for your new enterprise, it’s important to know your options. LLCs and S corps have a lot in common, and also a lot of differences. The tax differences between these two are especially important to understand. Any entrepreneur can appreciate the benefits […]

Continue reading

It’s extremely hard to fathom tax season is almost here, and the hottest tax topics for 2017 are now in the conversation. Whether you operate a small business or you’re an individual, it’s always important to take advantage of the tax benefits available to you. It’s even more important for you to accurately pay Uncle […]

Continue reading

While some tax planning strategies for small businesses may be aimed at the small business itself, others can be aimed at the owner’s individual tax situation. Regardless of how complex or simple the strategy is, tax planning for small businesses should revolve around: Minimizing the amount of taxable income Managing when the taxes must be […]

Continue reading